I’ve recently been reading How to Listen When Markets Speak by Lawrence McDonald and James Robinson, and it has got me thinking about my own investments and provided some though-provoking challenges to my investment strategy. This is a short post about one aspect that stood out to me from the book so far.

The standard advice for building wealth with minimal effort is to invest regularly in low-cost passive investment funds, stay invested in these securities for as long as possible, and adjust your investment mix as you near retirement or need the cash for other things. The idea being that at the end of your investment horizon you’ll have built up a large pot of money for a comfortable retirement.

This sounds like a good strategy, but what happens if everyone is doing the same? Won’t this behaviour create a bubble that will inevitably collapse? What effect does it have on markets? It seems that the success of these funds has been closely connected to a concept that consistently drives market behaviour: volatility.

What is the role of volatility?

Volatility is a measure of the variation in the price of a financial instrument over time. It’s a measure of risk and uncertainty, with high volatility indicating significant price swings and low volatility suggesting more stable prices.

When volatility is low, markets often experience bull runs. Central banks have been effectively supressing volatility due to the market-calming measures they had to put in place during the 2008 financial crisis. This intervention of printing money (quantitative easing, effectively buying unlimited quantities of securities from banks) and setting ultra-low interest rates prevented the markets correcting themselves and the failing companies from becoming insolvent.

Instead, the central banks over the world stepped in early to prevent failures. This created a highly profitable environment for professionals who knew how to take advantage of the situation to make a lot of profitable investments. Of course, the rest of us also benefited from generally rising markets, and passive ETFs and OEICs experienced similar price rises thanks to this suppressed volatility.

Is the market still liquid?

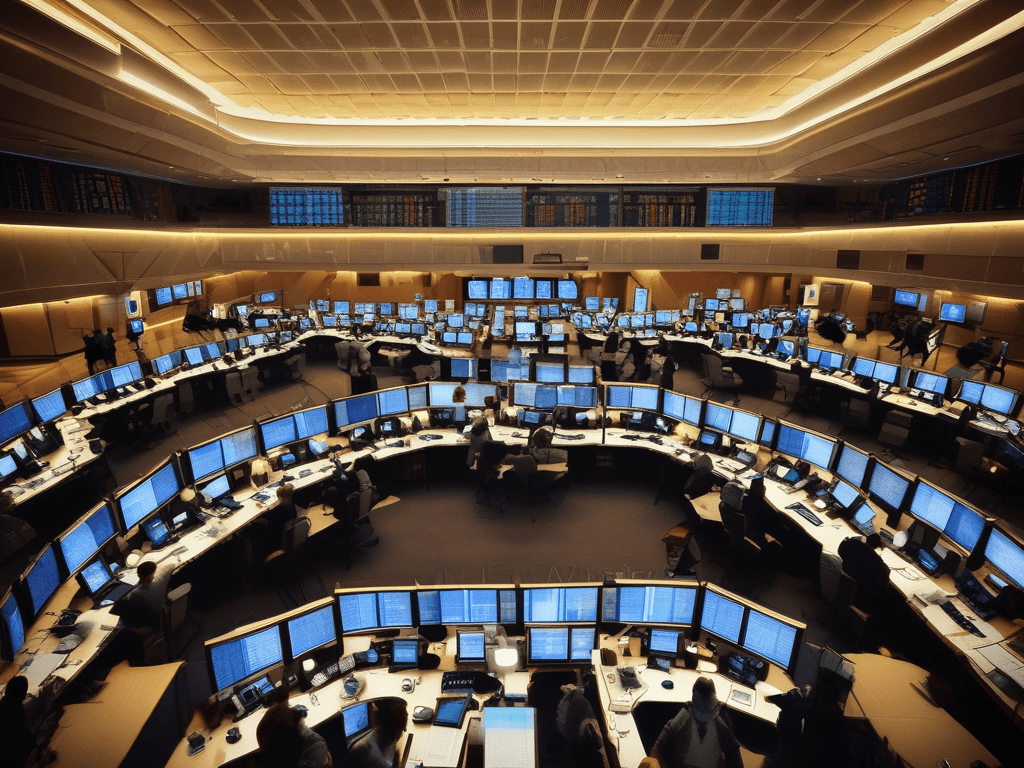

According to the book, passive and quant funds make up close to 80% of the daily stock market trading. The funds buy the market (using volume-weighted average prices). This predictable buying supresses the volatility even more, creating a feedback loop.

The obvious problem with a passive index fund strategy is that everyone is in the same trade, and nobody is aware of this lack of liquidity if the market was to suddenly decline. Active trading in the market leads to active and accurate pricing. If the trading is always in the same investments and with a buy and hold strategy then it could be argued that we are creating inefficiencies and potentially mispricing securities.

The converse may also be true, where investments that are only a very small part of the index by market cap may get less scrutiny and be mispriced in a way that investors can exploit, although active investing is not as easy as the passive approach so this is easier said than done.

The risks of passive fund asset allocation

If everyone is buying market-cap weighted index funds, this creates a concentration risk in a small number of investments. To quote How to Listen When Markets Speak again, “the percentage of profits enjoyed by the top one hundred companies shot up from 52 percent in 1997 to a staggering 84% in 2017 and nearly 90% in 2020”. I think this is a problem.

Profitability is bound to be positively correlated with market capitalisation and so the larger companies get an increasing amount of the capital being invested in them via these funds. This gives rise to the potential for asset bubbles due to the positive feedback loop. Are these funds really diversified enough for your needs?

What are the options for passive investors?

The old advice to diversify your investments still holds true. When you buy a passive fund that tracks the S&P500 index you are buying into the implicit diversification as a result of the industry mix within that index. However this is currently heavily weighted towards a small number of technology companies.

Similarly, if you invest in a FTSE All-World index fund hoping to get exposure to a wide range of countries, you’re buying the implicit geographical diversification that the fund offers, but that also often means that over 60% of the fund is invested in the S&P500. Are these funds really diversified enough for your needs?

This is not necessarily a bad thing however. As I mentioned above the vast majority of the profits are made by a small number of companies and the US economy is the world’s largest economy so this skew is logical. But you need to decide if this diversification is right for you and the level of risk you’re comfortable with.

My preferred option is to create my own asset allocation with a variety of passive funds focused on different geographic regions and sectors, and once I’ve chosen my preferred allocation, a few times a year I can check if the allocation is going astray and bring the proportions back into line. This has proved relatively easy to manage and in my experience the expenses have actually worked out lower than the all-world funds whilst giving me access to a larger number of companies.

Another option is to make use of the active investing opportunities available with a small amount of your portfolio that you are willing to lose (and of course, this willingness to lose your capital also applies to any investments you purchase, investing is not risk free and should not be taken lightly, though it applies more strongly to higher risk investments). Again, it comes down to how much time you are willing to devote to active investing.

The simplicity of an automated passive route is appealing because it means you are consistently investing each month and it takes the decision-making out of the equation, which helps avoid common pitfalls like panic selling, or trying to time the market, which have both been shown to be losing strategies.

Summary and conclusions

Lower trading fees, simplicity, automation, eliminating the human-error component and timing elements of the investing game are all strong reasons in support of passive investing. The investment strategy you choose is highly personal and you should consider what diversification would look like for your risk appetite and goals.

If you want to achieve a different type of diversification than what the funds choose for you, you may need to include a range of different passive funds that can help you achieve this, but be aware that this may come with extra work and potentially higher costs.

Let me know in the comments if you use a passive investment approach, and if you think yours actually gives you the diversification you need. Thanks for reading.

Leave a comment