I recently read How to listen when markets speak, by Lawrence McDonald and James Robinson. This book is quite new and has some interesting ideas about what has led in the past to market movements, economic shifts, and changes in investment portfolios, and based on the current economic conditions it makes suggestions on where we should be positioning our portfolios for maximizing returns over the next decade or so.

I’ll cover the main areas that stood out to me, though there’s plenty more of interest. There are also lots of great turns of phrase and interesting ways of looking at the world and how to manage a portfolio, giving a broader economic understanding and challenging the way most investors see the world.

Highlights from the book

The main takeaway for me is that inflation is not going away any time soon. How did we get into this mess? Quantitative Easing (QE). Governments have suppressed volatility in the markets by bailing out companies which would otherwise have failed.

This low volatility causes bull markets. This has benefited all investors, but investment professionals in particular, who find ways to exploit this market behaviour. It’s for this reason we need to be on the lookout for the policy response by the FOMC and other central banks as this can move markets significantly when investors have confidence that the Fed for example has made its final decision on interest rates.

Passive investing has further suppressed volatility, feeding on itself in a negative feedback loop. The US market is too heavily skewed towards a small number of companies, and these companies are being bought continuously by the large passive funds:

The percentage of profits enjoyed by the top one hundred companies shot up from 52 percent in 1997 to a staggering 84 percent in 2017 and nearly 90 percent in 2020

The author expresses the concern that there will be insufficient liquidity if these passive investments sell off simultaneously.

The US is losing its economic dominance. In particular, China is catching up very quickly. The Dollar’s reign as global reserve currency is at risk, with implications for American debt financing.

Global conflicts have also been responsible for a change in the focus of major economies, the US in particular. Much of the rhetoric has centred around re-shoring, taking American jobs back in-house, and not being reliant on other countries for important supply chains. This protectionist behaviour results in more inflation.

Another aspect of the book is around the reality of the green revolution and what it means for oil and gas producers and mining companies. An electric future is an impossibility at the moment, based on the amount of available copper in the world, so the need for oil and gas, particularly in the developing world is not going away, and hence presents an investment opportunity.

All of this means we need to position our portfolios to take advantage of the changing investment environment.

The indicators

There are some specific indicators mentioned in the book which can be used to gauge whether and where to invest. To help my understanding I have checked a few of these to confirm the trends and get some context for recent experience, for example:

- Larger proportions of stocks near 52 week lows can suggest a good time to be adding to portfolios. At the time of writing this, a simple investing.com stock screen suggests that there are 9,184 stocks near their 52 week low out of 10,548. This would suggest now might be a good time to buy.

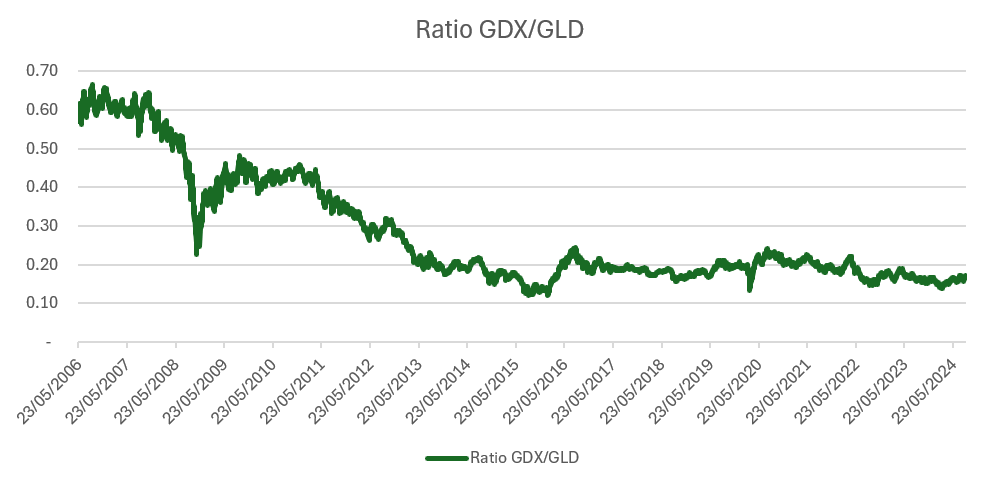

- The ratio of the gold miners ETF (GDX) to the gold ETF (GLD). According to the book a ratio below 0.15 suggests a buy signal for gold miners, with 0.2 or above suggesting a sell signal. This is plotted in the chart below, and suggests we are close to a buy signal as the ratio stands at 0.17.

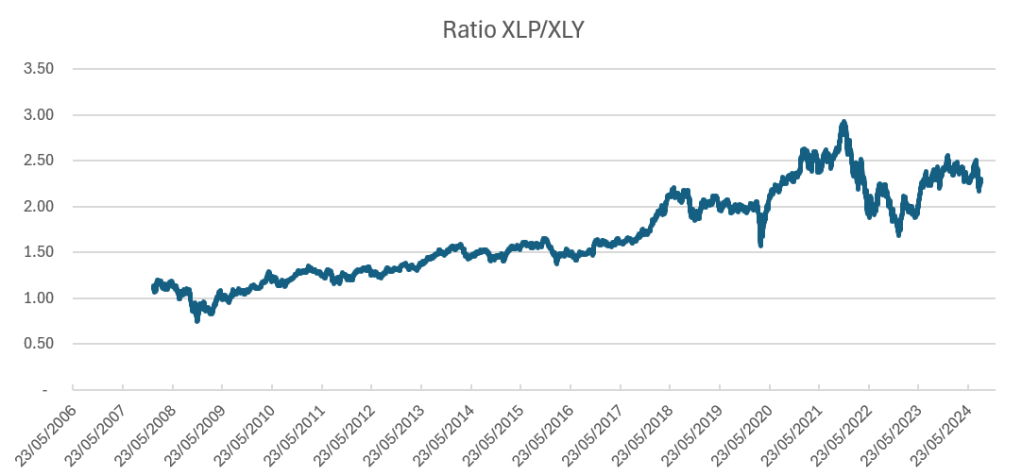

- Consumer staples ETF (XLP) to consumer discretionary ETF (XLY) ratios. This is plotted below. The higher the ratio, the more investors are moving towards value stocks which are focused on physical asset ownership and typically lower earning multiples. No ratio is suggested in the book as the trigger point for entering one or other of these, but there is some movement recently into staples, which would support adding this to the portfolio.

- Few stocks trading above their 200 day moving average. The book suggests that when few stocks (less than 17%) are trading above this it could suggest a buy signal. Again, according to a stock screen on investing.com there are 58% trading above their 200 day MA (but this is defined as trading 5% above it, so this may be defined more strictly compared to the book). This doesn’t suggest a buy signal, but there might be room for misinterpretation here, and another source of data may show otherwise.

Portfolio composition

The book suggests a slightly different split between the major asset classes compared to the traditional advice. Namely 40% equities, 30% bonds, 10% cash, and 20% commodities.

The strategy should be for the long term, waiting for the top two or three opportunities that come up in the year to make purchases. As the book mentions, patience and discipline is key:

when investing, the hardest thing to do is stare at a screen all day and do nothing

Commodity exposure

Given the above indicators suggesting the need for value assets rather than growth assets, and hence the need to own physical assets, and commodities in particular, the author suggests the following make sense to hold (among several other companies and ETFs):

- Oil and gas producers – Shell, Chevron, Exxon. Buy them on dips.

- Uranium (if you can stomach the volatility) – Cameco.

- Mining – BHP, Antofagasta, Barrick, Newmont, but stay away from smaller companies if you are not in the know as this industry represents a very high risk for investors.

Conclusions

It’s a great book and I’d recommend having a look to get all the details and see for yourself which viewpoints stand out and give you a different perspective on investing, as well as challenge how well your current portfolio is structured to cope with the next decade.

The ideas and evidence are persuasive and I’ve changed my attitude and approach in several areas as a result. I’ve also found some of the enjoyment I once had in investment research that I lost when I became a passive investor like almost everybody else.

Let me know in the comments if you’ve read the book and what you thought of it, or if my summary has sparked your interest. Thanks for reading.

Please note that none of the above constitutes advice; all investment comes with significant risk which should be carefully considered against your own risk appetite and experience. The mention of specific investments in this post does not mean I am giving a recommendation. As disclosure, I have investments in several of the companies mentioned.

Leave a comment