A quick one this week, part of a potential series of brief posts on stats that I find surprising. This week I want to cover ISAs (Individual Savings Accounts) in the UK. In particular highlighting the surprisingly low rate of subscriptions to stocks and shares ISAs.

What are stocks and shares ISAs?

In the simplest terms, they’re just accounts you open with a bank or broker or other investment provider (like Hargreaves Lansdown or Freetrade etc). You can pay money into them each tax year up to the limit (currently £20k) assuming this doesn’t exceed the aggregate limit that exists if you have multiple different types of ISA.

You can then buy shares, OEICs, ETFs and many other investment types with the deposits. Any profit you make from the investments (whether that’s capital gains, dividend income, or even interest on account balances) is completely tax-free and doesn’t eat into any of the usual capital gains, dividend or interest allowances.

How popular are stocks and shares ISAs?

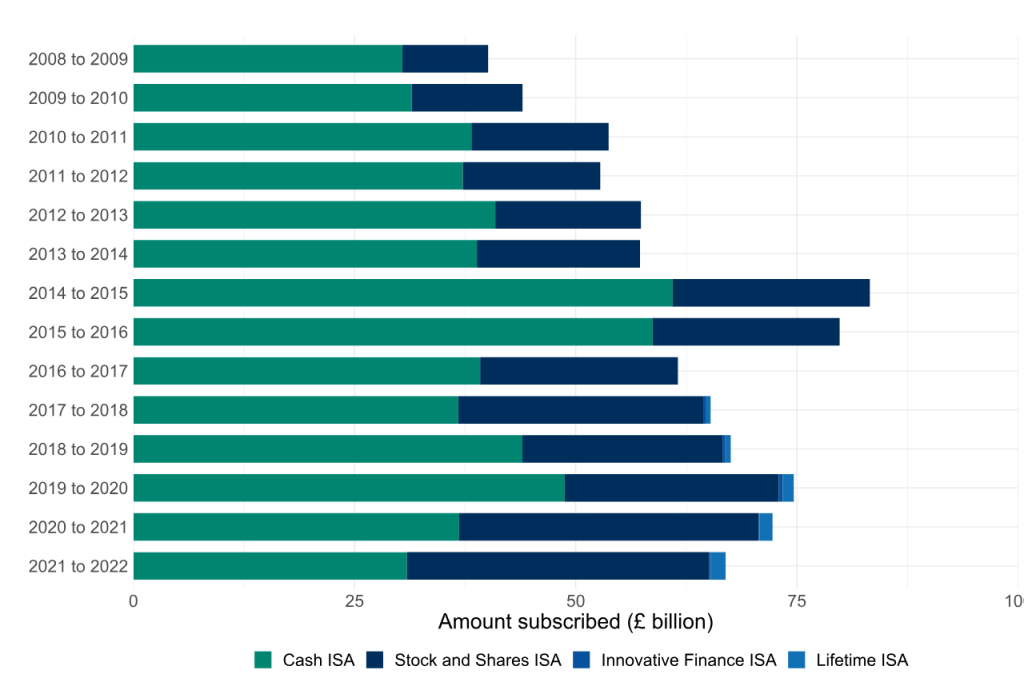

Based on the latest stats in the chart below from gov.uk and HMRC, there were less than 12 million ISA subscriptions in 2021/22, of which stocks and shares ISAs make up just under 4 million. The UK adult working-age population in the 2021 census was around 37.5m, which means only around 10% of the population made any contribution (or possibly no contribution in some cases, merely opening an account but leaving it unfunded) to a stocks and shares ISA and that’s pretty typical for other years too (some sites suggest it is an even lower percentage).

The graph below also suggests the overall number of ISAs seems to be falling or stable at best. It’s encouraging that the number of stocks and shares ISAs has been growing quite strongly in the last two years of data, but it’s still an under-used account.

How much is invested in stocks and shares ISAs?

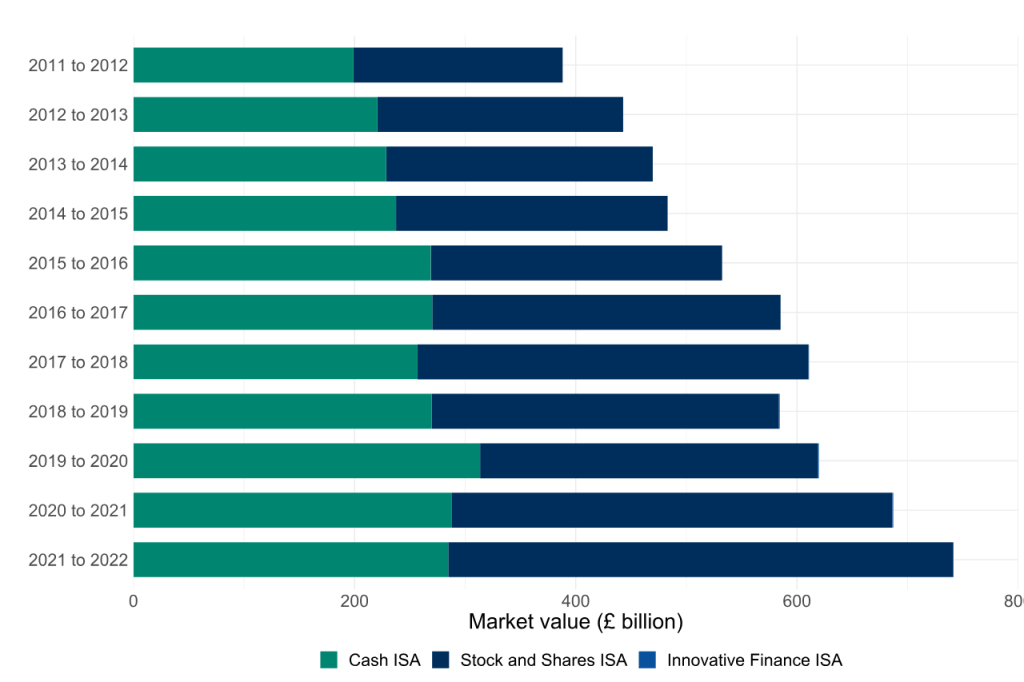

The graph below from the gov.uk website says a lot about the value and merits of holding a stocks and shares ISA compared to a cash ISA. Obviously there will be effects due to inflows and outflows throughout the period so it’s difficult to draw accurate conclusions, but the considerable growth in stocks and shares ISA value and the relative stagnation in cash ISA values suggests that many people are not getting the returns they need and are falling behind those who take advantage of these tax-efficient accounts to make investments.

How much is the average ISA subscription?

With the amounts that people are subscribing to ISAs with, it’s clear that only a select group of people are making significant contributions to a stocks and shares ISA. The wealthiest know a good deal when they see one (i.e. combining the compounding power of regular investing with low expense investments, and no tax deductions), and everyone else needs to be aware of this too as this method of building wealth works for everyone. Cash ISAs have their place but they just don’t cut it for this.

The graph below shows the mean amount that each type of ISA (cash and stocks and shares) is funded with each year. It’s worth remembering that the £20,000 subscription limit came into force in 2017, and even though there was an increase in the average subscription to stocks and shares ISAs then, the average amount is still below 50% of the limit.

If we looked at the distribution of ISA subscription amounts we would see even this relatively low mean is skewed upwards by a small number of high-income contributors investing the maximum amount possible each year. The median figure would likely reveal what the stats seem to suggest generally: people are not making enough use of this incredibly valuable (and actually quite generous) tax avoidance (not evasion) method.

What’s causing the low uptake of stocks and shares ISAs?

Clearly people will have many reasons for not investing in the stock market: low risk appetite, availability of funds, lack of understanding, confidence or advice, or a need to access the funds relatively soon making investing less suitable in the short-term, but the prevalence of cash ISAs and the poor inflation-adjusted returns they have traditionally offered in comparison to stocks and shares ISAs and the benefits of regular investing into a stocks and shares ISA need to be more widely advertised.

Conclusions

The stocks and shares ISA really is one of the best wealth-building tools we’ve got in the UK, and until it gets eroded by successive governments (with talk of capping the lifetime contributions at £100k, or continuing to not increase the limits with inflation as for the last six years), or with only tinkering proposed (like the Conservatives’ £5k ‘British ISA’ proposal which may not even see the light of day) everyone, regardless of income, should take advantage of the long-term benefits of regular investing and do it through a tax-efficient option like a stocks and shares ISA.

Leave a comment