If your net worth statement is like a company’s balance sheet, then a view of monthly income vs expenses is like the cashflow statement, and it plays an important role in understanding your progress towards increasing your net worth and reaching what you define as financial independence.

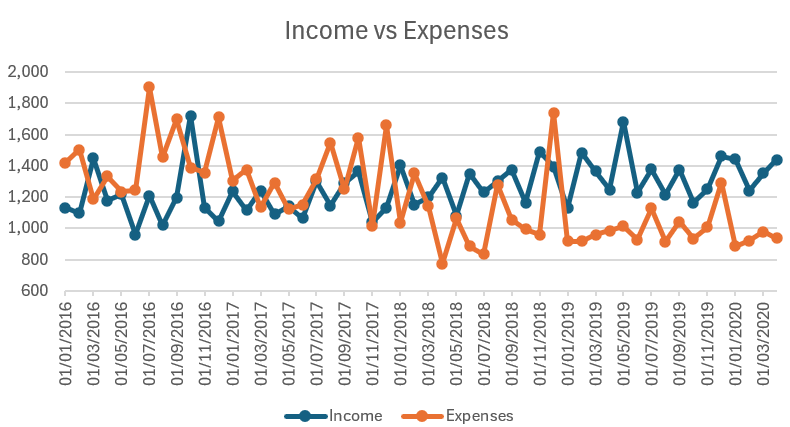

Monthly income and expenses

To state the obvious, income should be greater than expenses to create wealth consistently. If it’s not you need to identify what can change either by increasing your income or reducing expenses.

A budget is a good idea, and negotiating your bills lower, stopping expensive subscriptions, cutting down on or swapping non-essential luxuries, using higher interest accounts, and clearing credit card debt can all help here.

Before all that however, the first step is to get a picture of our current income and compare it with our expenses and see how it has changed over time. A money management tool like Money Manager EX can do this automatically if you have taken the time to enter all your individual transactions into it. It’s not a problem if you don’t have this, you’ll simply need to add all the sources of income and expenses and create a plot like the one below.

The fictitious example below shows how someone could go from fairly consistently spending more than they make (orange line above the blue line), or regularly having a problem with income barely meeting expenses (i.e. living payday to payday) to being comfortably in a monthly surplus (blue line above orange line) which they can put towards building an emergency fund and investing.

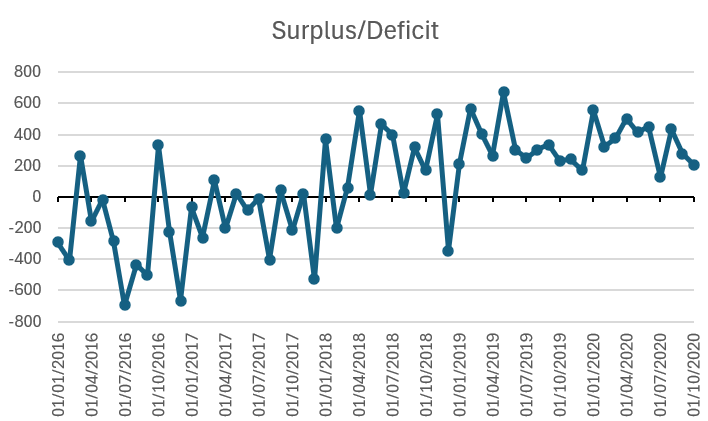

The difference between your income and your expenses is your personal budget deficit or surplus, and it can be useful to track this too, to identify more clearly whether there is a pattern and how much of a deficit there is to make up, or how much of a cushion you have with your surplus.

Sources of income and expenses are likely to be very seasonal, with expenses increasing around months with significant events such as birthdays, Christmas, holidays etc. and income increasing around periods when work bonuses are received or when investment income via dividends is paid for example. So it’s useful to see in general terms over a long time period if the difference between income and expenses is changing.

Seeing the budget surplus in this way makes financial planning easier since you know how much of a buffer you have each month before becoming over-stretched. It’s also very satisfying when you can see what was a difficult net-worth depleting situation turning around and becoming a strong wealth-creating cumulative surplus as in the graph below.

Lifestyle creep is a risk whenever income increases, and this tracking approach can help to keep this in check too. In the example (figure 1), there was a turning point in early 2018 when expenditure was cut and then maintained, and at the same time income increased slowly but consistently without expenses increasing over the same period. This is the ideal situation as it means there is now more room for investing the difference and growing net worth more quickly.

Having a dedicated application to track this and automatically output a monthly chart is my preferred option, but if the detail in these custom charts has you thinking it will be a lot of work, by all means you could look at this annually too and get similar insights. Setting up any kind of monitoring should be the goal to start with.

On the other hand if you have more time and interest to devote to this, you could also split the expenses into sub-categories to see which sources of expense are showing distinct trends. Many increases will be unavoidable due to general economic inflation (and that’s also interesting as you can estimate your own effective inflation rate) but on other categories you can potentially identify and make changes to lower costs.

How does your monthly budget surplus/deficit compare?

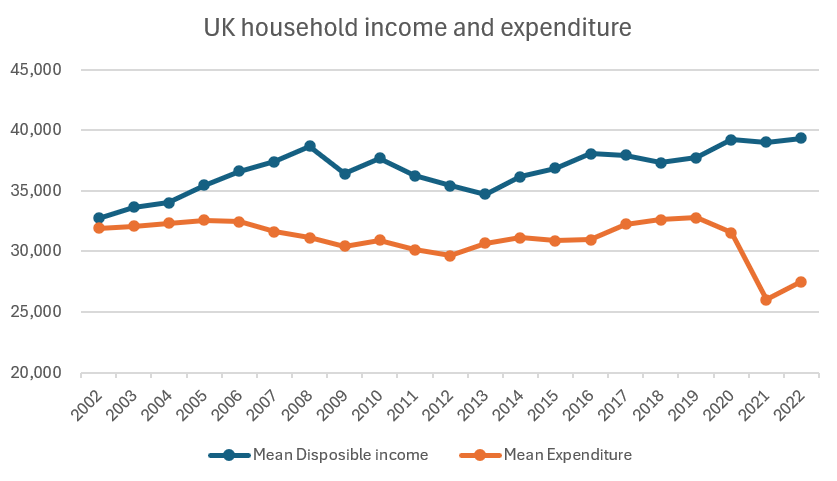

As I’ve said before, it’s not usually helpful to continually compare ourselves to others, but I think it’s fair to say, just as with net worth, this one will vary widely depending on age and income decile. Just looking at the mean income vs expenses for the whole UK (figure 4 below) suggests everything is going ok, with a strong budget surplus each year, but as we know the mean is skewed by some very large incomes, so this does not give a complete picture of how the average household is doing.

The data also shows that expenses dropped considerably during the pandemic as more households were forced to reduce their spending in many areas (I suspect mostly discretionary categories such as leisure, but also the usually unavoidable ones like commuting costs). With more up to date data I would expect this to have started to return closer to the pre-pandemic norm, but with more working remotely this could remain lower for longer.

In a future post I plan to explore how the budget surplus/deficit compares between the different income deciles over time, which should give a more representative picture of the average household. There are plenty of articles suggesting many households live payday to payday, so if you’re able to maintain a budget surplus and build up an emergency fund, savings and investments you’re doing better than many.

Summary and Conclusions

As with net worth, knowing where you stand with this metric allows you to take action to improve your surplus or reduce your deficit each month, which directly feeds into improving your net worth. It’s well worth adding this to your regular tracking. Let me know in the comments if you get any benefit from tracking your monthly income and expenses over time, or if you’ve got any different approaches. Thanks for reading.

Leave a comment